This calculator will help enter your savings rate, the savings period and the interest rate, and Excel will calculate your net savings after the saving period. Increase your interest rate, and you will immediately see how much faster you could reach the result of being a millionaire.

Now we just need a secure system that really creates a high interest rate 🙂

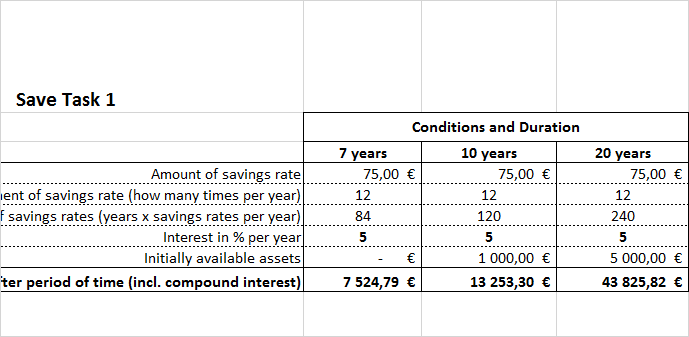

Have a look at the screenshot of the interest calculator excel template

Excel template for the calculation of interest and compound interest

Download the interest calculator template for free

- Interest calculator excel file download in format .xlsx

- Interest calculator excel template download in format .xltx

- all files in a zip

If you like my templates, I’m looking forward to a little donation 🙂

More interest calculator templates in the network

A little research showed that there are other good interest calculator templates to download: